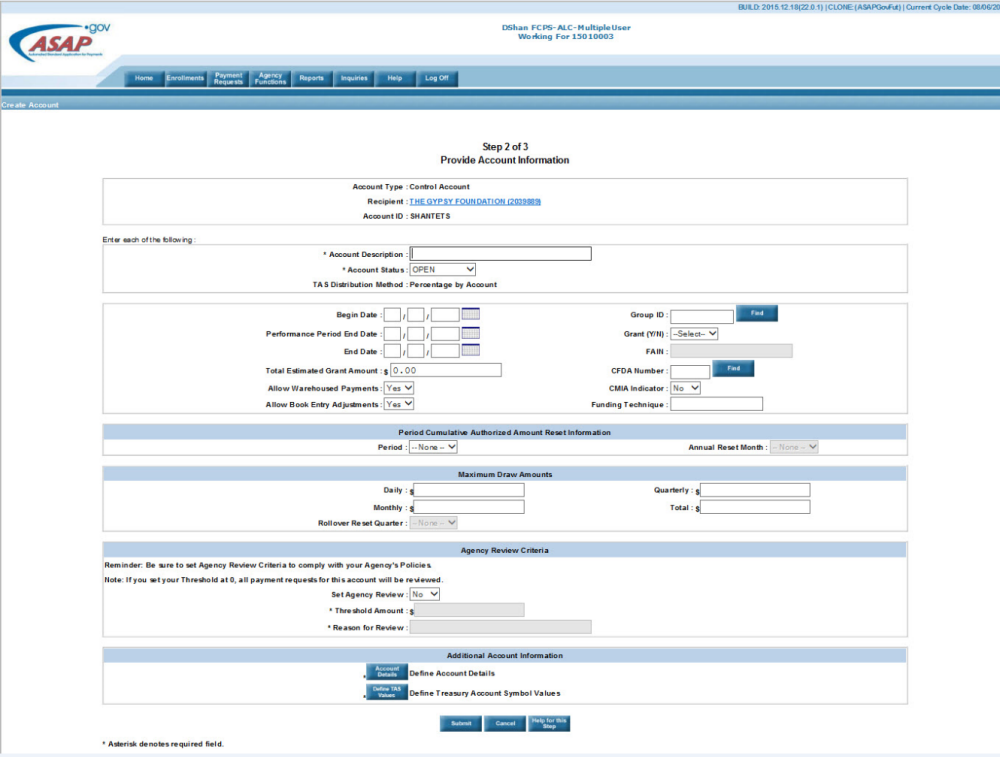

Step 2 of 3

Provide Account Information

Purpose of Step

The purpose of this step is to identify the attributes for the new account.

Click here to see Screen Graphic

Actions for this Step

1. Enter each of the following required attributes for the account:

· Account Description

o Each Account Description is from 1 to 30 characters long, consisting of letters and/or numbers.

· Account Status

o The account status defaults to Open, which allows the account to be available and active for all transactions. The other status available is Suspended.

o See Tips & Tricks for information on restrictions that apply to statuses.

2. Enter the following optional attributes for the account. Additional explanation of each attribute is available on the Accounts Home page.

· Begin Date , Performance Period End Date and End Date

o If a Begin Date is entered, an End Date is required.

o If a Performance Period End Date is entered, a Begin Date and End Date are required.

o Although the Begin Date is an optional attribute, a value is required; therefore, the system defaults to 01/01/1001.

o Although the Performance Period End Date and End Date are optional attributes, a value is required; therefore, the system defaults to 12/31/9999.

o When the current cycle date is greater than the Performance Period End Date, the system displays Error Message 9452.

·

·

· The (Federal Award Identification Number ) will be enabled and is required if the Grant is "Yes" .

· CFDA Number

o This field is not available for 1031/LOC, Global, and Global Control account types.

· CMIA Indicator

o This field is not available for 1031/LOC account types.

·

o Funding Technique must be entered if the CMIA Indicator is set to 'Yes'.

o This field is not available for the 1031/LOC account type.

· Total Estimated Grant Amount

o This field is not available for 1031/LOC, Global, and Global Control account types.

· Warehoused Payments

o Warehoused Payments are those initiated with a settlement date of between 2 and 32 days in the future.

o If Warehoused Payments is set to ‘No’ on the Federal Agency profile, this option is not available for Regular, Control, Global or Global Control accounts.

o This field is not available for 1031/LOC accounts.

· Book Entry Adjustments

o Book Entry Adjustments allow the Requestor to adjust available balances between two accounts that have the same Recipient and Federal Agency.

o If Book Entry Adjustments is set to ‘No’ on the Federal Agency profile, this option is not available for Regular, Control, Global or Global Control accounts.

o This field is not available for 1031/LOC account types.

· Period Cumulative Authorized Amount Reset Information

o The cumulative authorized amount can be tracked on a monthly , quarterly , or annual basis.

o If you select an annual Reset Period, you must indicate the month in which the total is reset to zero.

· Maximum Draw Amount Information

o Maximum Draw Amounts are displayed for Regular, Control, and 1031/LOC account types.

o Maximum Draw Amounts can be identified on a daily, monthly, quarterly, and total basis. If set on a quarterly basis and a Rollover Reset Quarter is designated, the system will allow any balances outstanding from the prior quarter to “rollover” to the next quarter in all instances except the Rollover Reset Quarter.

o The Rollover Reset Quarter can either be designated by the agency or can be left on “None.” If left on “None,” balances outstanding from previous quarters will not continue to rollover indefinitely.

o Maximum Draw Amount information is set at the Requestor/Recipient Pair level for Global and Global Control accounts and is, consequently, not visible on this screen for these account types. See PROVIDE REQUESTOR/RECIPIENT PAIRS for more information.

· Agency Review Criteria

o If Set Agency Review is Yes, then the Threshold Amount and reason must be entered.

o The Threshold Amount is the amount above which the payment request will be held for agency review. When this occurs, the agency will receive an email and/or online notification .

o The ASAP.gov system will send a reminder every three business days that action is pending on payments for agency review.

o Agency Review is set at the Requestor/Recipient Pair level for Global and Global Control accounts.

o Agency Review is not available to the 1031/LOC Account type.

· Automated Renewal

o Options for Automated Renewal Period are monthly and quarterly. If a Period is selected, an amount is required.

o Automated Renewal action must be certified. The Pending Automated Renewal Criteria section is displayed if the previously defined Automated Renewal Criteria has not been certified.

o This function is available to only 1031 accounts when the agency flag for Automated Renewal is set to 'Yes.'

3. Define TAS details by clicking on the Define TAS Values button.

· See the Define TAS/BETC Values section for more information.

4. Enter Account Details for a Control or Global Control Account by clicking on the Add Details button.

· See the Account Details section for more information.

5. Enter Requestor/Recipient Pairs for a Global or Global Control Account by clicking on the Requestor/Recipient Pair button.

· See the Requestor/Recipient Pairs section for more information.

6. Click Submit .

Next Step

Home Page

Procedures

Error Message Explanation